BTC Price Prediction: Path to $200,000 Amid Current Market Correction

#BTC

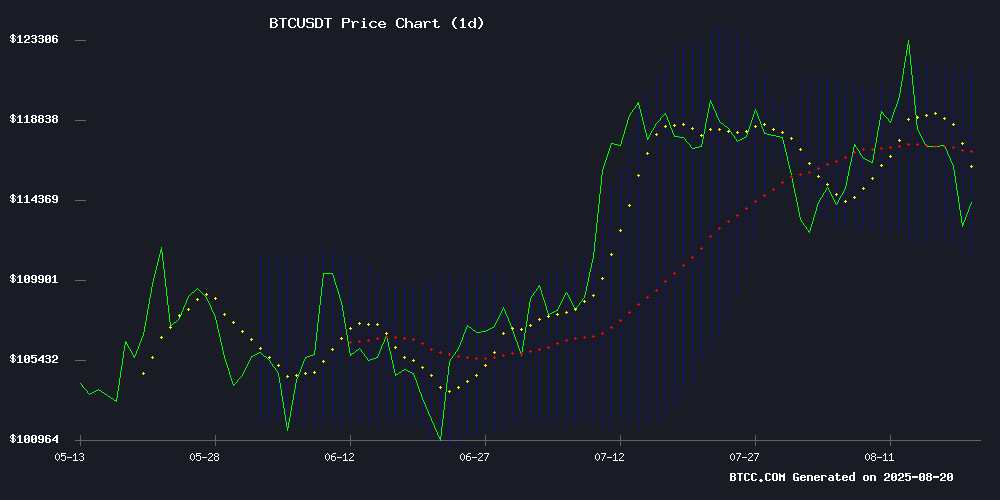

- Technical indicators show bearish momentum with price below 20-day MA and negative MACD

- Market sentiment mixed due to institutional selling offset by long-term adoption news

- $110,000-$120,000 range critical for determining next major price movement direction

BTC Price Prediction

Technical Analysis: BTC Shows Bearish Signals Below Key Moving Average

BTC is currently trading at $113,443, below the critical 20-day moving average of $116,461, indicating near-term bearish pressure. The MACD reading of -1023.48 confirms downward momentum, while price action NEAR the lower Bollinger Band at $111,127 suggests potential support testing. According to BTCC financial analyst Michael, 'The technical setup shows consolidation below the middle band, with the $111,000 level becoming crucial for maintaining bullish structure.'

Market Sentiment: Correction Phase Amid Institutional Moves and Regulatory Concerns

Current market sentiment reflects caution as Bitcoin corrects below $115,000 amid substantial liquidations and mixed institutional signals. While SoFi's Lightning Network integration and Brazil's proposed $19B reserve indicate long-term adoption, Ark 21Shares' $64.4M sale and MicroStrategy's stock decline contribute to near-term uncertainty. BTCC financial analyst Michael notes, 'The convergence of technical correction and macroeconomic pressures creates a complex sentiment landscape where $110,000 support becomes psychologically significant.'

Factors Influencing BTC's Price

Crypto Market Retreats as Fear Grips Investors

The cryptocurrency market continues its downward trajectory, with total capitalization shedding another 1.4% to $3.83 trillion. Early Thursday saw a dip to $3.79 trillion—9% below the recent peak of $4.17 trillion. Cryptocurrencies once again proved more reactive than traditional risk assets, with the Nasdaq100 showing relative resilience.

Market sentiment has deteriorated sharply, with the Crypto Fear & Greed Index plunging to 44 (fear) from 75 (near extreme greed) just six days prior. Bitcoin briefly touched $112.5k before finding tentative support, though technical indicators turned bearish after breaking below the 50-day moving average. The next critical test lies at $108k—a breach could open the floodgates to $100k.

On-chain data reveals troubling signals. CryptoQuant reports short-term bitcoin holders are selling at a loss for the first time since January—a phenomenon last seen during the deepest correction of the previous cycle. Santiment flags additional warning signs: BTC's August highs came on weaker volume than July's rally, while exchange reserves show concerning accumulation patterns.

SoFi Integrates Bitcoin Lightning Network for Cross-Border Transfers

SoFi has partnered with Lightspark, a Bitcoin infrastructure firm founded by ex-PayPal president David Marcus, to embed blockchain-powered payments into its mobile banking platform. The collaboration marks the first integration of Bitcoin's Lightning Network and Universal Money Address (UMA) system by a U.S. bank, targeting frictionless cross-border remittances.

The service will debut in Mexico before expanding to other high-volume corridors. Transactions convert dollars to Bitcoin at market rates, route via Lightning for near-instant settlement, then deliver local currency directly to recipients' accounts. SoFi's UMA implementation replaces traditional banking codes with email-like identifiers, streamlining the transfer process.

This MOVE challenges legacy remittance providers by offering 24/7 settlement without conventional delays or fees. The Lightning Network's scalability positions SoFi to potentially undercut competitors like Western Union and MoneyGram on both speed and cost for international money movement.

Harvard Economist Criticizes US Crypto Regulation as Bitcoin's Role Expands

Kenneth Rogoff, Harvard economist and former IMF chief, admits he underestimated Bitcoin's resilience and the US regulatory inertia. A decade ago, he predicted BTC would crash to $100 rather than approach $100,000. "I was far too optimistic about sensible cryptocurrency regulation," Rogoff concedes, questioning why policymakers would enable tax evasion and illicit activity.

Bitwise CIO Matt Hougan counters Rogoff's critique by emphasizing Bitcoin's decentralized nature. The asset derives strength from its people-powered network, not centralized institutions—a factor Rogoff allegedly overlooked. This debate underscores the growing tension between traditional finance perspectives and crypto's disruptive ethos.

Ark 21Shares' $64.4M Bitcoin Sale Sparks Debate on Market Direction

Ark 21Shares has offloaded 559.85 BTC worth $64.4 million, triggering speculation about institutional motives. The move coincides with Bitcoin's derivatives market cooling, as Open Interest plunges to $81 billion—a weekly low.

Market participants are divided. Some interpret the sale as profit-taking after BTC's recent rally, while others see signs of institutional short positioning. The decline in Open Interest suggests traders are closing positions rather than increasing exposure, reflecting growing caution.

CryptoQuant data reveals net unrealized profits have hit their lowest point this week. Long-term holders appear to be locking in gains, signaling weakened conviction in the current uptrend. The derivatives market's cooling could foreshadow increased short pressure as institutions capitalize on recent gains.

Analyst Foresees Bitcoin Plunge Below $100,000 in September Amid Market Correction

Bitcoin's rally above $24,000 proved short-lived as prices retreated, prompting crypto analyst Doctor Profit to forecast a drop below $100,000 in September. The prediction suggests a deepening correction phase, with August's bullish momentum fading as bearish pressures mount.

Historical support at $100,000, tested twice since June, now faces a critical challenge. Despite the grim outlook, Doctor Profit maintains the broader bull market remains intact, implying a temporary setback rather than a trend reversal.

Bitcoin Corrects Below $115K Amid $961M Liquidations as Technicals Turn Bearish

Bitcoin's rally stalled abruptly as prices plunged below $115,000, triggering $961 million in Leveraged liquidations across crypto markets. The sell-off follows last week's record high above $124,000, with technical indicators now suggesting potential downside toward $110,000 support.

Market data reveals dangerous overleveraging, with long positions constituting most liquidations. Over 60% of BTC/USDT perpetual contracts remain skewed long, creating cascading risk if the correction deepens.

Chart patterns flash warning signals—a weekly rising wedge formation suggests 26% downside potential to $88,000, while the daily chart completes a bearish double-top with $101,000 as the next target. Momentum weakens as RSI forms a descending channel despite recent highs.

All eyes now turn to Federal Reserve policy cues, with traders awaiting minutes and Chair Powell's commentary for directional clues. The institutional adoption narrative faces its first significant technical test since Bitcoin's latest breakout.

Brazil Proposes $19B Bitcoin Reserve to Hedge Against Currency Risks

Brazil's Chamber of Deputies will debate a groundbreaking bill to allocate up to $18.6 billion in bitcoin as strategic reserves. The August 20 hearing marks the first legislative step for Bill 4501/24, which aims to shield the nation's treasury from forex volatility using blockchain solutions.

The proposal cites El Salvador's Bitcoin adoption and EU blockchain initiatives as precedents. Brazil's Central Bank WOULD custody the RESBit holdings, with mandatory risk assessments every six months. The country already ranks 10th globally in crypto trading volume, processing $76 billion in digital asset transactions last year.

This move positions Brazil at the forefront of sovereign digital asset adoption in Latin America. Four parliamentary committees will scrutinize the legislation following the initial hearing, evaluating its economic, technological, and constitutional implications.

Bitcoin Faces Market Correction Amid Economic Data Concerns

Bitcoin's price trajectory has shifted downward following its recent all-time high of $124,128 on August 14. The cryptocurrency now trades at $113,597, marking an 8.5% decline from its peak. Market data reveals a 1.3% drop in the last 24 hours, with weekly losses extending to 4.8%.

The correction appears linked to macroeconomic factors, particularly higher-than-expected producer price index data. This development has dampened expectations for Federal Reserve rate cuts, triggering a wave of liquidations totaling $450.55 million across crypto markets. The single largest liquidation occurred on Binance's BTC/USDT pair, valued at $9.70 million.

Technical indicators suggest $112,000 as a critical support level. A breach below $110,000 could accelerate selling pressure, potentially testing the psychological $100,000 threshold. Market participants remain watchful for institutional responses to these price movements.

Bitcoin's Rising Cost Challenges Retail Investors

Bitcoin's price surge has made owning a full coin an increasingly rare milestone for retail investors. Glassnode data shows a 1.0% increase in supply held by first-time buyers, yet the barrier to entry grows steeper as prices climb.

Only about 1 million wallet addresses hold 1 BTC or more, with most accumulation occurring before 2018 when prices were below $1,000. The slowdown in new 'whole coiners' since 2018 underscores how Bitcoin's bull runs price out smaller investors.

CoinGecko's analysis reveals a stark reality: at $100,000 per BTC, becoming a whole coiner requires 100x more capital than during the 2017 cycle. This accessibility crunch may reshape Bitcoin's investor demographics as institutional players dominate larger allocations.

Bitcoin Demand Dips Amid Macro Pressures, $110K Support in Focus

Bitcoin's demand has sharply declined from over 170K BTC in early August to just 50K BTC, accelerating its recent pullback from $124K to $112.5K. CryptoQuant's Head of Research, Julio Moreno, attributes the price retracement to this demand slowdown. Despite the dip, speculators are increasing bets on a $120K-$130K price target, signaling lingering bullish sentiment.

Macro risks loom as Federal Reserve Chair Jerome Powell prepares to speak at the Jackson Hole Symposium on August 22. Wall Street analyst Tom Lee anticipates a hawkish stance from Powell but predicts a subsequent market rally. Meanwhile, Coinbase's David Duong warns of potential dollar liquidity drains, with the U.S. Treasury expected to borrow $400B, which could dampen BTC and crypto sentiment in the short term.

MicroStrategy Stock Plummets Amid Policy Shift and Bitcoin Downturn

MicroStrategy's stock (MSTR) has tumbled to a four-month low following a contentious update to its equity issuance policy and a broader slump among Bitcoin-focused public companies. The shares have dropped 8% since Monday, mirroring Bitcoin's 8.6% decline from last week's peak.

CEO Michael Saylor revised the company's at-the-market equity guidance, removing restrictions on share issuance when the stock trades below 2.5 times net asset value. The new policy permits share sales to cover debt interest, preferred dividends, or whenever deemed advantageous—a stark departure from previous constraints.

Investor backlash has been swift, with some accusing Saylor of reneging on commitments made during earnings calls. "He made this agreement with shareholders live on air," lamented one former investor. The debate now centers on whether this flexibility will ultimately benefit Bitcoin accumulation strategies or erode shareholder trust.

Will BTC Price Hit 200000?

Based on current technical indicators and market sentiment, reaching $200,000 requires overcoming significant resistance levels and renewed institutional momentum. The current correction below the 20-day MA at $116,461 and bearish MACD suggest near-term consolidation. However, fundamental developments like Brazil's proposed reserve and Lightning Network adoption provide long-term support. BTCC financial analyst Michael states, 'While $200,000 remains a plausible target in the next bull cycle, current conditions suggest a period of accumulation between $110,000-$120,000 before any sustained upward movement.'

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $113,443 | Below 20-day MA |

| Support | $111,127 | Lower Bollinger Band |

| Resistance | $116,461 | 20-day Moving Average |

| Upper Target | $121,796 | Upper Bollinger Band |

| Long-term Target | $200,000 | Psychological Resistance |